How Many Home Loans can a Person Take in India?

The number of home loans an individual can hold in India has no statutory limit, but depends on income, credit score, and existing debt obligations.

Major banks like SBI, HDFC, and ICICI assess loan eligibility based on the borrower's repayment capacity. The Fixed Obligation to Income Ratio (FOIR) typically allows EMIs up to 40-50% of monthly income. A credit score of 750 or above improves chances of approval for multiple loans.

Co-applicants can be added to increase combined eligibility. The total EMI burden across all loans must remain manageable within the borrower's income. Banks may have internal caps on total loan amounts or EMIs to mitigate risk.

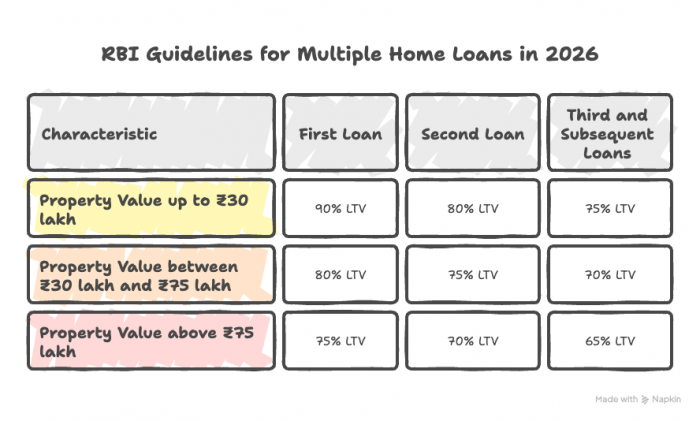

The Loan-to-Value (LTV) ratio decreases for second and subsequent home loans, impacting the maximum loan amount obtainable. For properties up to ₹30 lakh, the LTV drops from 90% for the first loan to 80% for the second and 75% for the third and beyond.

Income tax deductions under Section 24 and Section 80C apply to multiple home loans. The maximum deduction for principal repayment across all loans is ₹1.5 lakh per year. For self-occupied properties, the interest deduction limit is ₹2 lakh per year, while there is no limit for rented properties.

- No statutory limit on the number of home loans.

- Eligibility depends on income, credit score, and debt.

- LTV ratio decreases for subsequent loans.

- Tax deductions available for principal and interest.

Understanding how many home loans can a person take in India involves assessing income, credit score, and existing debt obligations, as major banks like SBI, HDFC, and ICICI do not impose a statutory limit on concurrent home loans in 2026.

| Aspect | Details |

|---|---|

| Income Level | Key factor in loan eligibility |

| Credit Score | 750+ improves eligibility |

| Existing Debt | Affects repayment capacity |

| Co-applicants | 2-3 allowed to pool incomes |

Overview of Home Loans

Types of Loans

Types of Loans vary significantly when considering home loans in India as of November 2025. Major banks like SBI, HDFC, and ICICI do not limit the number of concurrent home loans an individual can hold. Eligibility depends on factors such as income, credit score, and existing debt obligations.

- Income Level and Repayment Capacity are key for loan approval.

- Banks assess the Fixed Obligation to Income Ratio (FOIR), allowing EMIs up to 40-50% of monthly income.

- A Credit Score of 750 or above enhances eligibility for multiple loans.

- Existing Debt impacts loan approval as it affects repayment capacity.

- Adding Co-applicants can increase combined eligibility for loans.

The Loan-to-Value (LTV) ratio for home loans decreases with each subsequent loan. For properties up to ₹30 lakh, the LTV for a first home loan is 90%, dropping to 80% for a second home loan, and 75% for third and subsequent loans. This reduction impacts the maximum loan amount obtainable and increases the required down payment.

- First home loan LTV can be up to 90% for properties up to ₹30 lakh.

- Second home loan LTV reduces to 80% for the same property value.

- Third and subsequent home loans have an LTV of 75% for properties up to ₹30 lakh.

Income tax implications for multiple home loans in the financial year 2026-2027 include deductions under Section 24 and Section 80C. The total principal repayment across all loans can be deducted up to ₹1.5 lakh under Section 80C. For interest payments, the deduction limit is ₹2 lakh per year for self-occupied properties, with no limit for rented properties.

- Section 80C allows a maximum deduction of ₹1.5 lakh for principal repayment.

- Section 24 permits a deduction of up to ₹2 lakh for interest on self-occupied properties.

- No upper limit exists for interest deductions on rented properties.

Understanding the different types of loans and their implications is crucial for effective financial planning and loan management.

Key Terms.

- Income Level: Banks assess the borrower's repayment capacity, often allowing EMIs up to 40-50% of monthly income.

- Credit Score: A high score, ideally 750 or above, improves eligibility for multiple home loans.

- Existing Debt Obligations: Outstanding loans and liabilities impact eligibility as they reduce repayment capacity.

- Co-applicants: Banks allow 2-3 co-applicants to pool incomes and enhance loan eligibility.

The Loan-to-Value (LTV) ratio varies for subsequent home loans, affecting the maximum loan amount obtainable.

- First Home Loan: Up to 90% LTV for properties up to ₹30 lakh, 80% for ₹30 lakh to ₹75 lakh, and 75% for above ₹75 lakh.

- Second Home Loan: LTV reduced by 5-10 percentage points from the first loan.

- Third and Subsequent Home Loans: LTV further reduced by 5 percentage points.

Income tax implications for multiple home loans in 2026-2027 include deductions under Section 24 and Section 80C.

- Section 80C: Maximum deduction of ₹1.5 lakh per year on total principal repayment across all loans.

- Section 24: For self-occupied properties, up to ₹2 lakh per year on total interest paid; no limit for rented properties.

Understanding these key terms helps borrowers navigate the complexities of securing multiple home loans in India.

Bank Eligibility Criteria

Age Limits

Age Limits for loan applicants vary across major banks in India. SBI, HDFC, and ICICI consider factors like income, credit score, and existing debt. There is no fixed age limit for loan eligibility.

- Banks assess the borrower's repayment capacity.

- Eligibility depends on income level and credit history.

- No statutory limit on the number of concurrent home loans.

The Loan-to-Value (LTV) ratio impacts the maximum loan amount. For second and subsequent home loans, the LTV ratio decreases. This affects the loan amount borrowers can obtain.

- First home loan LTV up to 90% for properties up to ₹30 lakh.

- Second home loan LTV reduced by 5-10 percentage points.

- Third and subsequent home loans see a further 5% LTV reduction.

Income tax implications for multiple home loans include deductions under Section 24 and Section 80C. The principal repayment deduction is capped at ₹1.5 lakh per year. Interest deductions vary based on property occupancy.

- Section 80C: Maximum ₹1.5 lakh for total principal repayment.

- Section 24: Up to ₹2 lakh for self-occupied properties.

- No limit on interest deduction for rented properties.

Understanding age limits and related financial factors is crucial for loan applicants in India.

Income Levels

Income levels play a crucial role in determining the minimum income required for loan approval in India as of November 29, 2025.

- Banks assess borrowers' repayment capacity using the Fixed Obligation to Income Ratio (FOIR), allowing EMIs up to 40-50% of monthly income.

- A high credit score, ideally 750 or above, improves eligibility for multiple home loans.

- Existing debt obligations reduce repayment capacity, impacting loan approval.

- Co-applicants can pool incomes to enhance loan eligibility, with banks allowing 2-3 co-applicants.

The total EMI burden across all loans must remain manageable within the borrower's income levels to secure loan approval.

Credit Score Requirements

Score Ranges

Score Ranges play a crucial role in determining eligibility for multiple home loans in India. Banks assess credit scores to gauge a borrower's creditworthiness. A high score, typically 750 or above, enhances the chances of loan approval.

- Borrowers with scores of 750+ are more likely to secure multiple home loans.

- Lower scores may limit the number of loans one can hold.

- Credit scores influence the Loan-to-Value (LTV) ratio, affecting the maximum loan amount.

The impact of score ranges extends to the LTV ratio for subsequent home loans. For a second home loan, the LTV is reduced by 5-10 percentage points compared to the first. This reduction continues for third and subsequent loans, further limiting the loan amount.

- First home loan LTV can be up to 90% for properties up to ₹30 lakh.

- Second home loan LTV drops to 80% for the same property value.

- Third and subsequent loans see an LTV of 75% or lower.

Income tax implications for multiple home loans also hinge on score ranges. A strong credit score can lead to better loan terms, affecting the interest and principal components. This, in turn, influences the deductions under Section 24 and Section 80C.

- Section 80C allows a maximum deduction of ₹1.5 lakh on total principal repayment across all loans.

- Section 24 permits up to ₹2 lakh in interest deductions for self-occupied properties.

- No upper limit exists for interest deductions on rented properties.

Improving Scores

Improving scores on credit reports is essential for securing multiple home loans in India in 2026. A high credit score, ideally 750 or above, enhances eligibility for additional loans. Banks assess creditworthiness based on income, existing debt, and repayment history.

- Maintain a credit score of 750+ for easier loan approvals.

- Ensure total EMIs do not exceed 40-50% of monthly income.

- Consider adding co-applicants to boost combined eligibility.

The Loan-to-Value (LTV) ratio decreases for second and subsequent home loans, impacting the maximum loan amount. For properties up to ₹30 lakh, the LTV drops from 90% for the first loan to 80% for the second and 75% for the third. This reduction necessitates higher down payments for additional loans.

- First home loan LTV can reach 90% for properties up to ₹30 lakh.

- Second home loan LTV is reduced by 5-10 percentage points.

- Third and subsequent loans see a further 5% LTV reduction.

Income tax deductions under Section 24 and Section 80C apply to multiple home loans in 2026-2027. The principal repayment deduction is capped at ₹1.5 lakh annually across all loans. Interest deductions for self-occupied properties are limited to ₹2 lakh per year, while there is no limit for rented properties.

- Section 80C allows up to ₹1.5 lakh deduction for principal repayment.

- Section 24 permits ₹2 lakh interest deduction for self-occupied homes.

- No cap on interest deductions for rented properties.

Improving scores remains crucial for managing multiple home loans effectively. A strong credit profile supports higher loan eligibility and favorable tax benefits. Strategic financial planning can optimize loan and tax outcomes.

Debt-to-Income Ratio

Calculation Method

The Calculation Method for determining the debt-to-income ratio involves comparing monthly debt payments to gross monthly income. This ratio helps assess an individual's ability to manage additional debt. Lenders use this to evaluate loan eligibility.

- Calculate total monthly debt payments.

- Divide by gross monthly income.

- Result shows percentage of income used for debt.

Applying the Calculation Method ensures a clear understanding of financial health. It aids in making informed decisions about taking on new loans. This method remains relevant for financial planning into early 2026.

Ideal Ratios

Ideal Ratios play a crucial role in determining loan approval. For home loans in India, banks assess the debt-to-income ratio to gauge repayment capacity. A lower ratio increases the likelihood of loan approval.

- Banks allow EMIs up to 40-50% of the borrower's monthly income.

- A credit score of 750 or above improves eligibility for multiple loans.

- Existing debt obligations reduce the borrower's repayment capacity.

- Co-applicants can pool incomes to enhance loan eligibility.

The ideal ratios for loan approval remain a key factor in financial planning.

Approval Process

Application Steps

The Application Steps for a home loan in India involve understanding key eligibility criteria and LTV ratios as of November 2025.

- Borrowers can hold multiple home loans based on income, credit score, and debt obligations.

- LTV ratios decrease for second and subsequent loans, affecting maximum loan amounts.

- Principal repayment deductions under Section 80C are capped at ₹1.5 lakh annually across all loans.

- Interest deductions under Section 24 are limited to ₹2 lakh for self-occupied properties.

Following these Application Steps ensures a clear path to securing multiple home loans in India.

Documentation

Documentation for loan applications requires specific documents. These documents help banks assess eligibility for home loans. Proper documentation ensures a smooth application process.

- Proof of identity: Aadhaar card, passport, or driver's license.

- Proof of address: Utility bills, rental agreement, or property documents.

- Income proof: Salary slips, bank statements, or income tax returns.

- Property documents: Title deeds, sale agreement, or no-objection certificate.

- Credit report: To verify credit score and history.

Submitting complete documentation increases the chances of loan approval. Banks review these documents to determine loan eligibility. Accurate and thorough documentation is essential for successful loan applications.

Processing Time

Factors Affecting

Factors Affecting the number of concurrent home loans an individual can hold in India in 2026 include income, credit score, and existing debt obligations. Major banks like SBI, HDFC, and ICICI do not set a statutory limit on the number of loans. Instead, they assess the borrower's repayment capacity.

- Income level determines the Fixed Obligation to Income Ratio (FOIR), with banks allowing EMIs up to 40-50% of monthly income.

- A credit score of 750 or above improves eligibility for multiple loans.

- Existing debt reduces repayment capacity, affecting loan eligibility.

- Banks may allow 2-3 co-applicants to pool incomes and enhance loan eligibility.

The Loan-to-Value (LTV) ratio also impacts the maximum loan amount for second, third, and subsequent home loans. For properties up to ₹30 lakh, the LTV for a second home loan is 80%, and for third and subsequent loans, it drops to 75%. Higher LTV ratios for first home loans result in lower down payments, while subsequent loans require higher down payments.

- First home loan LTV can be up to 90% for properties up to ₹30 lakh.

- Second home loan LTV is reduced by 5-10 percentage points.

- Third and subsequent home loans see a further 5 percentage point reduction in LTV.

Income tax implications for multiple home loans in the financial year 2026-2027 include deductions under Section 24 and Section 80C. The total principal repayment across all loans can be deducted up to ₹1.5 lakh under Section 80C. For self-occupied properties, the interest deduction is capped at ₹2 lakh under Section 24.

- Section 80C allows a maximum deduction of ₹1.5 lakh for principal repayment across all home loans.

- Section 24 permits a ₹2 lakh deduction for interest on self-occupied properties.

- No upper limit exists for interest deductions on rented properties.

Factors Affecting home loan eligibility and tax implications are crucial for individuals planning to hold multiple home loans in India in 2026.

RBI Guidelines

Key Regulations

Key Regulations set by the Reserve Bank of India (RBI) guide home loan eligibility in 2026. Major banks like SBI, HDFC, and ICICI do not limit the number of home loans an individual can hold. Instead, they assess the borrower's income, credit score, and existing debt obligations.

- Banks use the Fixed Obligation to Income Ratio (FOIR), allowing EMIs up to 40-50% of monthly income.

- A credit score of 750 or above improves loan eligibility.

- Existing debt reduces repayment capacity, affecting loan approval.

- Co-applicants can increase combined eligibility by pooling incomes.

The RBI also sets Loan-to-Value (LTV) ratios for home loans. These ratios decrease for second, third, and subsequent loans. This impacts the maximum loan amount a borrower can obtain.

- For properties up to ₹30 lakh, the LTV is 90% for the first loan, 80% for the second, and 75% for third and subsequent loans.

- For properties between ₹30 lakh and ₹75 lakh, the LTV is 80% for the first loan, 75% for the second, and 70% for third and subsequent loans.

- For properties above ₹75 lakh, the LTV is 75% for the first loan, 70% for the second, and 65% for third and subsequent loans.

Income tax implications for multiple home loans in 2026-2027 include deductions under Section 24 and Section 80C. The total principal repayment deduction across all loans is capped at ₹1.5 lakh per year. Interest deductions vary based on whether properties are self-occupied or rented.

- Section 80C allows a maximum deduction of ₹1.5 lakh for principal repayment across all home loans.

- Section 24 permits a deduction of up to ₹2 lakh for interest on self-occupied properties.

- For rented properties, there is no upper limit on interest deductions.

Adhering to these key regulations ensures borrowers can manage multiple home loans effectively.

LTV Ratio Impact

<div class="video-container">

<iframe src="https://www.youtube.com/embed/s55f2J699aM" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>

</div>

<p style="text-align: center; font-style: italic; font-size: 0.9em; color: #666;">Video: Home Loan LTV Ratio Explained | Loan to Value Ratio | Home Loan in India (Groww)</p>LTV Calculation

LTV Calculation for home loans in India varies based on whether it is a first, second, or subsequent loan. The Reserve Bank of India sets guidelines that major banks and housing finance companies follow. These guidelines determine the maximum loan amount relative to the property's value.

- For a first home loan, the maximum LTV can be up to 90% for properties valued up to ₹30 lakh.

- Second home loans have a reduced LTV by 5-10 percentage points compared to the first loan.

- Third and subsequent home loans see a further reduction in LTV by 5 percentage points.

The impact of LTV Calculation on loan amounts is significant. For example, a property worth ₹50 lakh allows a maximum loan of ₹40 lakh for a first home, but only ₹37.5 lakh for a second home. This reduction continues for third and subsequent loans, affecting the down payment and potential interest rates.

- Higher LTV for first loans means lower down payments.

- Subsequent loans require higher down payments due to lower LTV.

- Interest rates may increase for second and subsequent loans due to higher risk.

LTV Limits

LTV Limits set by the Reserve Bank of India (RBI) for home loans in 2026 vary based on the order of the loan and the property value. For a first home loan, the maximum LTV can reach up to 90% for properties valued up to ₹30 lakh.

- For properties between ₹30 lakh and ₹75 lakh, the LTV drops to 80%.

- Properties above ₹75 lakh have a maximum LTV of 75% for the first home loan.

The LTV for a second home loan decreases by 5-10 percentage points. For example, a property valued at ₹50 lakh allows a maximum loan of ₹40 lakh for a first home, but only ₹37.5 lakh for a second home.

- For third and subsequent home loans, the LTV reduces by another 5 percentage points.

- A ₹50 lakh property would then have a maximum loan of ₹35 lakh for a third or subsequent home loan.

These LTV Limits directly impact the maximum loan amount obtainable and the required down payment, with higher LTVs for first home loans leading to lower down payments.

Interest Rate Differentials

Fixed vs. Floating

Fixed vs. Floating interest rates offer different benefits for home loan borrowers. Fixed rates provide stability with a constant interest rate throughout the loan term. Floating rates, however, fluctuate with market conditions, potentially offering lower rates initially.

- Fixed rates ensure predictable monthly payments.

- Floating rates can decrease if market rates fall.

- Choosing between them depends on one's risk tolerance and financial planning.

When considering Fixed vs. Floating rates, assess your financial situation. Fixed rates protect against rising interest rates. Floating rates might save money if rates decline.

- Evaluate current market trends before deciding.

- Consider the loan duration and your long-term financial goals.

- Fixed rates offer peace of mind; floating rates offer potential savings.

Rate Trends

Rate Trends in the Indian housing market for November 2025 show a dynamic landscape influenced by multiple home loan eligibility and LTV ratios. Major banks like SBI, HDFC, and ICICI do not impose a statutory limit on the number of concurrent home loans. Instead, eligibility hinges on factors such as income level, credit score, and existing debt obligations.

Banks assess borrowers' repayment capacity using the Fixed Obligation to Income Ratio (FOIR), allowing EMIs up to 40-50% of monthly income. A credit score of 750 or above enhances eligibility for multiple loans. Existing debt significantly impacts the ability to secure additional loans due to its effect on repayment capacity.

The Loan-to-Value (LTV) ratio for home loans varies based on the sequence of the loan. For a first home loan, the LTV can reach up to 90% for properties valued up to ₹30 lakh. Subsequent loans see a reduction in LTV, affecting the maximum loan amount obtainable.

For second home loans, the LTV drops by 5-10 percentage points, and for third and subsequent loans, it decreases by another 5 points. This means higher down payments and potentially higher interest rates for additional properties. The RBI continues to monitor these trends to manage systemic risk.

Income tax implications for multiple home loans in the financial year 2026-2027 include deductions under Section 24 and Section 80C. The total principal repayment across all loans can be deducted up to ₹1.5 lakh under Section 80C. For self-occupied properties, the interest deduction is capped at ₹2 lakh under Section 24, while there is no limit for rented properties.

Understanding these rate trends is crucial for making informed decisions about home loan applications and tax planning in the coming months.

- No statutory limit on concurrent home loans.

- Eligibility based on income, credit score, and debt.

- LTV ratios decrease for second and subsequent loans.

- Tax deductions available under Sections 24 and 80C.

Tax Implications

Deductions Available

Deductions Available for home loan borrowers in India during the financial year 2026-2027 include benefits under Section 24 and Section 80C. These deductions apply to both principal and interest components of multiple home loans. Understanding these can help maximize tax savings.

- Under Section 80C, the total principal repayment across all home loans can be deducted up to ₹1.5 lakh per year.

- For self-occupied properties under Section 24, the total interest paid can be deducted up to ₹2 lakh annually.

- For rented properties, there is no upper limit on interest deductions, allowing full interest paid to be claimed.

These deductions available are crucial for individuals managing multiple home loans, ensuring they can optimize their tax benefits effectively.

Tax Planning

Tax Planning for multiple home loans in India during the financial year 2026-2027 involves understanding key tax deductions.

Under Section 80C, individuals can claim a deduction of up to ₹1.5 lakh on the total principal repayment across all home loans. This limit applies regardless of whether the properties are self-occupied or rented.

For interest payments, Section 24 allows a deduction of up to ₹2 lakh per year for self-occupied properties. If multiple self-occupied homes are owned, the total interest deduction cannot exceed this amount.

For rented or deemed-to-be-rented properties, there is no upper limit on interest deductions. Borrowers can claim the full interest paid on home loans for such properties.

- Section 80C: Maximum ₹1.5 lakh deduction on principal repayment.

- Section 24: Up to ₹2 lakh for self-occupied properties; no limit for rented properties.

Effective tax planning requires careful management of these deductions to optimize tax benefits from multiple home loans.

Property Valuation

Valuation Methods

Valuation Methods are crucial for determining property values in real estate transactions. Different methods help assess the worth of properties accurately. These methods vary based on the type of property and the purpose of valuation.

- Comparative Market Analysis (CMA): Compares the property to similar properties recently sold in the area.

- Income Approach: Used for rental properties, it calculates value based on potential income.

- Cost Approach: Estimates the cost to replace the property, useful for unique or new constructions.

- Sales Comparison Approach: Similar to CMA but often used in formal appraisals.

Choosing the right valuation method depends on the property's characteristics and the intended use of the valuation. Accurate valuation ensures fair pricing and informed decision-making in real estate. Applying these methods correctly maximizes the benefits for buyers and sellers alike.

Risks and Benefits

Potential Risks

Potential Risks of taking multiple home loans include financial strain and reduced eligibility for future loans.

- Higher total EMIs can exceed 40-50% of monthly income, leading to repayment challenges.

- Lower LTV ratios for second and subsequent loans mean larger down payments and possibly higher interest rates.

- Tax deductions under Section 24 and Section 80C have caps, limiting benefits for multiple loans.

Managing potential risks requires careful financial planning and understanding of loan terms.

Key Benefits

The Key Benefits of securing multiple home loans in India include financial flexibility and tax advantages.

- Financial flexibility allows borrowers to invest in multiple properties.

- Tax deductions under Section 24 and Section 80C reduce taxable income.

- Higher loan amounts possible with co-applicants.

These Key Benefits make multiple home loans an attractive option for property investment.

Alternative Investments

Investment Options

Investment Options for home loans in India in 2026 include multiple concurrent loans. Major banks like SBI, HDFC, and ICICI do not limit the number of home loans. Eligibility depends on income, credit score, and existing debt.

- Banks assess repayment capacity using Fixed Obligation to Income Ratio (FOIR).

- A high credit score (750+) improves chances for multiple loans.

- Co-applicants can increase combined eligibility.

The Loan-to-Value (LTV) ratio decreases for second and subsequent home loans. For properties up to ₹30 lakh, the LTV drops from 90% for the first loan to 80% for the second and 75% for the third. This impacts the maximum loan amount obtainable.

- First home loan: Up to 90% LTV for properties up to ₹30 lakh.

- Second home loan: Up to 80% LTV for the same property value.

- Third and subsequent loans: Up to 75% LTV.

Income tax implications for multiple home loans in 2026-2027 include deductions under Section 24 and Section 80C. The principal repayment deduction under Section 80C is capped at ₹1.5 lakh total across all loans. Interest deductions vary based on property occupancy status.

- Section 80C: Maximum ₹1.5 lakh deduction for principal repayment.

- Section 24: Up to ₹2 lakh for self-occupied properties; no limit for rented properties.

Choosing the right investment options involves understanding these key factors for home loans in India.

Pros and Cons

The pros and cons of holding multiple home loans in India in 2026 hinge on eligibility criteria and tax implications. Major banks like SBI, HDFC, and ICICI do not set a statutory limit on concurrent loans. Instead, they assess a borrower's income, credit score, and existing debt obligations.

Banks use the Fixed Obligation to Income Ratio (FOIR) to gauge repayment capacity. A high credit score, ideally 750 or above, enhances eligibility for multiple loans. Co-applicants can also be added to increase combined income and improve loan approval chances.

The Loan-to-Value (LTV) ratio decreases for second and subsequent home loans. For properties up to ₹30 lakh, the LTV drops from 90% for the first loan to 80% for the second and 75% for the third. This reduction impacts the maximum loan amount obtainable and increases the required down payment.

Income tax deductions under Section 24 and Section 80C apply to multiple home loans. The principal repayment deduction is capped at ₹1.5 lakh per year across all loans. For self-occupied properties, the interest deduction limit is ₹2 lakh per year, while there is no cap for rented properties.

- Eligibility depends on income, credit score, and debt.

- LTV ratios decrease for subsequent loans.

- Tax deductions have specific limits for principal and interest.

Understanding the pros and cons of multiple home loans helps in making informed financial decisions in 2026.

| Investment Type | Pros | Cons |

|---|---|---|

| Home Loans | No statutory limit on number of concurrent loans; eligibility based on income and credit score | High cumulative debt can reduce chances of approval; total EMIs should not exceed 40-50% of income |

| Second Home Loans | LTV ratio up to 75% for loans up to ₹30 lakh | Lower LTV ratio compared to first home loans; impacts maximum loan amount |

| Third Home Loans | LTV ratio up to 75% for loans up to ₹30 lakh | Same LTV ratio as second home loans but higher risk assessment |

Data relevant for the next 3 months from November 29, 2025

Government Schemes

Eligibility Criteria

Eligibility Criteria for availing government schemes in India in 2026 depend on several key factors. Major banks like SBI, HDFC, and ICICI assess borrowers based on income level, credit score, and existing debt obligations. There is no statutory limit on the number of concurrent home loans an individual can hold.

- Income level and credit score are crucial for loan approval.

- Existing debt obligations impact the borrower's repayment capacity.

- Banks use parameters like Fixed Obligation to Income Ratio (FOIR) to determine eligibility.

The Loan-to-Value (LTV) ratio varies for second, third, and subsequent home loans. For properties up to ₹30 lakh, the maximum LTV for a second home loan is 80%, and for third and subsequent loans, it is 75%. Higher LTV ratios for first home loans result in lower down payments.

- First home loan LTV can be up to 90% for properties up to ₹30 lakh.

- Second home loan LTV is reduced by 5-10 percentage points.

- Third and subsequent home loans have LTV reduced by another 5 percentage points.

Income tax implications for individuals holding multiple home loans in 2026-2027 include deductions under Section 24 and Section 80C. The maximum deduction for principal repayment across all loans is ₹1.5 lakh per year. For self-occupied properties, the interest deduction limit is ₹2 lakh per year.

- Section 80C allows a total principal repayment deduction of ₹1.5 lakh.

- Section 24 permits a ₹2 lakh interest deduction for self-occupied properties.

- No upper limit exists for interest deductions on rented properties.

Understanding the Eligibility Criteria is essential for navigating home loan applications effectively.

Benefits Offered

The benefits offered by different government schemes in India for home loans in 2026 include tax deductions under Section 24 and Section 80C.

- Section 80C allows a maximum deduction of ₹1.5 lakh per year on the total principal repayment across all home loans.

- For self-occupied properties, Section 24 permits a deduction of up to ₹2 lakh per year on the total interest paid across all such properties.

- For rented properties, there is no upper limit on the interest deduction under Section 24.

These benefits offered can significantly reduce the financial burden of holding multiple home loans.

Rejection Reasons

Common Issues

Common issues leading to rejection of multiple home loan applications in India include inadequate income and high existing debt. Banks assess the borrower's repayment capacity using the Fixed Obligation to Income Ratio (FOIR). A high credit score and manageable EMI burden are crucial for approval.

- Income level must support total EMIs within 40-50% of monthly income.

- Credit score should ideally be 750 or above for easier approvals.

- Existing debt reduces the capacity to take on more loans.

- Co-applicants can help increase combined eligibility.

The Loan-to-Value (LTV) ratio decreases for second and subsequent home loans. For properties up to ₹30 lakh, the LTV drops from 90% for the first loan to 80% for the second and 75% for the third. This reduction impacts the maximum loan amount obtainable.

- First home loan: Up to 90% LTV for properties up to ₹30 lakh.

- Second home loan: Up to 80% LTV for the same property value.

- Third and subsequent loans: Up to 75% LTV for properties up to ₹30 lakh.

Income tax implications for multiple home loans include deductions under Section 24 and Section 80C. The total principal repayment deduction across all loans is capped at ₹1.5 lakh per year. Interest deductions vary based on whether properties are self-occupied or rented.

- Section 80C: Maximum ₹1.5 lakh deduction for principal repayment.

- Section 24: Up to ₹2 lakh for interest on self-occupied properties.

- No limit on interest deduction for rented properties.

Addressing common issues like income, credit score, and LTV ratios can improve the chances of securing multiple home loans.

Avoiding Rejection

Avoiding rejection when applying for multiple home loans in India requires understanding key eligibility criteria. Major banks like SBI, HDFC, and ICICI focus on income, credit score, and existing debt obligations rather than a fixed limit on the number of loans. These factors determine a borrower's repayment capacity.

- Income Level: Banks assess the Fixed Obligation to Income Ratio (FOIR), allowing EMIs up to 40-50% of monthly income.

- Credit Score: A score of 750 or above enhances eligibility for multiple loans.

- Existing Debt: Outstanding loans reduce repayment capacity, affecting loan approval.

- Co-applicants: Adding 2-3 family members can pool incomes and improve loan eligibility.

The Loan-to-Value (LTV) ratio also impacts loan approval. For second and subsequent home loans, the LTV decreases, requiring higher down payments. This affects the maximum loan amount obtainable.

- First Home Loan: Up to 90% LTV for properties up to ₹30 lakh.

- Second Home Loan: LTV reduced by 5-10 percentage points.

- Third & Subsequent Home Loans: LTV further reduced by 5 percentage points.

Income tax implications for multiple home loans include deductions under Section 24 and Section 80C. The principal repayment across all loans can be deducted up to ₹1.5 lakh per year. Interest deductions vary based on whether properties are self-occupied or rented.

- Section 80C: Maximum deduction of ₹1.5 lakh for total principal repayment.

- Section 24: Up to ₹2 lakh for interest on self-occupied properties; no limit for rented properties.

By carefully managing income, credit, and debt, borrowers can improve their chances of avoiding rejection when applying for multiple home loans.

Frequently Asked Questions

How many home loans can a person take in India?

There is no statutory limit on the number of home loans an individual can hold in India. Eligibility depends on income, credit score, and existing debt obligations, with banks assessing the borrower's repayment capacity. What factors do banks consider when approving multiple home loans?

Banks consider income level, credit score, credit history, and existing debt obligations. The Fixed Obligation to Income Ratio (FOIR) typically allows EMIs up to 40-50% of monthly income. Can co-applicants help in getting multiple home loans?

Yes, banks allow 2-3 co-applicants, often family members, to pool incomes and improve loan eligibility for multiple home loans. What is the importance of credit score in securing multiple home loans?

A high credit score, generally 750 or above, improves eligibility for multiple home loans. Banks assess creditworthiness to determine loan approvals. How does the total EMI burden affect the approval of multiple home loans?

The total EMI burden across all loans should not exceed 40-50% of the borrower's gross monthly income. High cumulative debt can reduce the chances of approval. Do banks have internal caps on total loan amounts or EMIs?

Yes, banks may have internal caps on total loan amounts or EMIs to mitigate risk, even though there is no statutory limit on the number of loans. How do SBI, HDFC, and ICICI Bank approach multiple home loans?

SBI, HDFC, and ICICI Bank focus on income, credit history, and repayment capacity rather than a fixed limit on loan numbers. They aim for growth while maintaining strong underwriting standards. What is the Loan-to-Value (LTV) ratio for second, third, and subsequent home loans?

The LTV ratio for second, third, and subsequent home loans follows standard guidelines: up to 75% for loans up to ₹30 lakh, 70% for loans between ₹30-75 lakh, and 65% for loans above ₹75 lakh.