Chandigarh Housing Board Sector 53 Scheme 2025: Complete Guide for Affordable Flats in Chandigarh

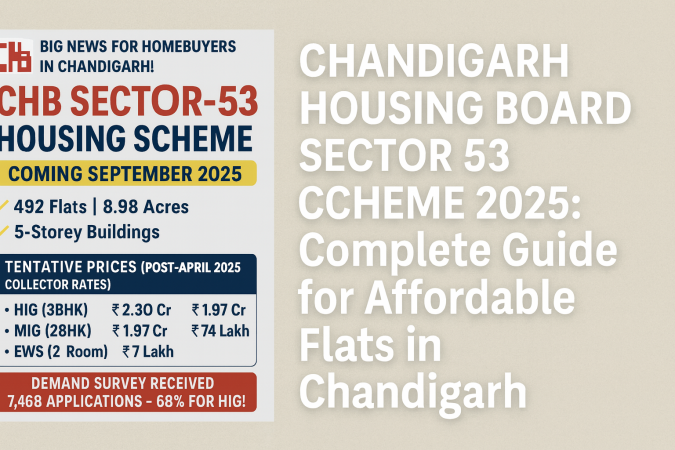

Given the high competition, applicants should consider multiple financing options and be prepared for the draw process. For those planning ahead, start your home loan preparation with Ambak's pre-approval process. Understanding the payment schedule is crucial for financial planning when purchasing a CHB Sector 53 flat. The scheme offers multiple payment options to suit different financial capabilities. *Assuming 31.2% tax bracket (30% + 3% cess + 10% surcharge) Get your home loan pre-approved before the scheme launches. This gives you a clear budget and faster processing once selected. Use Ambak's platform to compare pre-approval offers from multiple banks. For detailed EMI calculations and comparison of loan offers, use Ambak's EMI calculator to plan your finances effectively. Sector 53 in Chandigarh offers strategic location advantages that make it an attractive choice for homebuyers. The sector combines the tranquility of residential living with excellent connectivity to major commercial and business hubs. Several infrastructure projects are planned or under construction near Sector 53, which will further enhance its connectivity and value: Sector 53's strategic location makes it an excellent investment option with strong appreciation potential: The location advantages make CHB Sector 53 flats an attractive proposition for both end-users and investors. For financing your investment, explore competitive home loan options through Ambak's platform. When considering CHB Sector 53 flats, it's important to compare them with other available housing options in the Chandigarh tricity area. This comparison will help you make an informed decision based on your requirements and budget. When comparing financing options for CHB flats vs private projects, CHB offers certain advantages: For comprehensive comparison of home loan rates for CHB flats, use Ambak's comparison tool to find the best financing options. Breaking Update (August 28, 2025): The launch of CHB Sector 53 scheme is likely to be delayed due to the absence of a comprehensive EWS (Economically Weaker Section) policy. This development has significant implications for prospective applicants. Making an informed investment decision about CHB Sector 53 flats requires careful analysis of various factors. Here's a comprehensive evaluation to help potential buyers make the right choice: Overall Verdict: CHB Sector 53 flats represent a solid investment opportunity for long-term homebuyers and conservative investors. The combination of government backing, competitive pricing, and strategic location makes it attractive despite current delays. Risk-Adjusted Returns: Expected annual returns of 8-10% through capital appreciation with minimal risk make it suitable for portfolio diversification. For financing your CHB flat investment, compare the best home loan options through Ambak's comprehensive platform to maximize your investment returns. A: As of August 2025, the scheme launch is delayed due to pending EWS (Economically Weaker Section) policy formulation by the UT Administration. The new expected timeline is March 2026. A: The scheme offers 372 flats distributed as: 192 HIG (3BHK), 100 MIG (2BHK), and 80 EWS (2BHK) units. Some sources mention 492 flats, but 372 appears to be the confirmed number. A: Revised prices are: HIG (3BHK) - ₹2.30 crore, MIG (2BHK) - ₹1.97 crore, EWS (2BHK) - ₹74 lakhs. These represent a 35-40% increase from earlier proposed rates. A: Indian citizens aged 18+ who are bona fide residents of UT Chandigarh and don't own any residential property in Chandigarh, Mohali, or Panchkula. Specific reservations exist for SC/ST, OBC, defence personnel, and disabled individuals. A: No, only one application per family per category is allowed. Multiple applications will result in cancellation of all applications. A: Yes, all previous survey participants will need to submit fresh applications when the scheme officially launches. A: EMD varies by category: HIG - ₹3 lakhs, MIG - ₹2 lakhs, EWS - ₹1 lakh. This amount is adjustable against the final payment if selected. A: Yes, all major banks and HFCs offer home loans for CHB flats. Government backing makes loan approval easier. You can compare rates from 50+ lenders through Ambak's platform. A: You can choose between CHB's 5-installment plan (12% interest over 24 months) or opt for a home loan with lower interest rates (8.5-9% typically) for longer tenure. A: CHB uses a computerized draw system in two phases: first draw for basic allotment and second draw for specific floor/flat selection. The process is transparent and conducted publicly. A: Construction is estimated to take 36 months from the date of issue of Allotment-cum-Demand Letter (ACDL). A: Your EMD will be refunded, and you may be placed on a waiting list for any cancellations. You can also participate in future CHB schemes. A: CHB flats offer good long-term investment potential with lower risk due to government backing. Expected annual appreciation is 8-10% with minimal legal complications. A: Additional costs include stamp duty (5-6%), registration charges (1%), maintenance deposit (₹25,000-50,000), and brochure fee (₹1,000). A: Yes, CHB flats have good resale value and liquidity. There are no restrictions on sale after taking possession, making them freely transferable. A: Basic amenities include lifts, power backup, parking (basement for HIG, stilt for others), community center, gym, temple, medical facility, and green spaces. A: CHB follows government construction standards with RCC frame structure, vitrified tile flooring, UPVC windows, concealed wiring, and modern plumbing systems. A: Yes, HIG flats get basement parking (two levels), while MIG and EWS flats have designated stilt and surface parking respectively. For more specific queries about financing your CHB flat, use Ambak's EMI calculator to plan your budget effectively. For accurate and up-to-date information about the CHB Sector 53 scheme, always rely on official sources. Here are the verified contact details and important links:Payment Schedule & Financial Planning

CHB Installment Plan (12% Interest)

Installment

Timeline

HIG (₹2.30 Cr)

MIG (₹1.97 Cr)

EWS (₹74 L)

1st Installment

At ACDL (30 days)

₹46 L

₹39 L

₹15 L

2nd Installment

6 months

₹46 L

₹39 L

₹15 L

3rd Installment

12 months

₹46 L

₹39 L

₹15 L

4th Installment

18 months

₹46 L

₹39 L

₹15 L

5th Installment

24 months

₹46 L

₹39 L

₹14 L

Total with Interest

24 months

₹2.76 Cr

₹2.36 Cr

₹89 L

Home Loan vs CHB Installment Comparison

Tax Benefits with Home Loans

Tax Benefit

Section

Max Benefit

Annual Savings*

Principal Repayment

80C

₹1.5 Lakhs

₹46,800

Interest Payment

24(b)

₹2 Lakhs

₹62,400

First-time Buyer

80EEA

₹1.5 Lakhs

₹46,800

Total Annual Benefit

-

Up to ₹5 Lakhs

₹1.56 Lakhs

Financial Planning Tips

1. Pre-Approval Strategy

2. Down Payment Planning

3. EMI Planning

4. Documentation Readiness

Location Benefits & Connectivity

Strategic Location Benefits

Detailed Connectivity Analysis

Destination

Distance

Travel Time

Route/Mode

Sector 17 (City Center)

8 km

15-20 min

Via Madhya Marg

Chandigarh Airport

15 km

25-30 min

Via Airport Road

Railway Station

12 km

20-25 min

Via NH-5

IT Park (Rajiv Gandhi)

6 km

12-15 min

Direct connectivity

Mohali City Center

10 km

18-22 min

Via Kharar Road

Panchkula

14 km

22-28 min

Via NH-5

Delhi (via Expressway)

260 km

3.5-4 hrs

Western Peripheral Expressway

Future Infrastructure Developments

Neighborhood Amenities

Amenity Type

Facility Name

Distance

Quality Rating

Education

Government Model Senior Secondary School

2 km

⭐⭐⭐⭐

Healthcare

Government Multi Specialty Hospital Sector 16

5 km

⭐⭐⭐⭐

Shopping

Elante Mall

8 km

⭐⭐⭐⭐⭐

Banking

SBI, HDFC, ICICI Bank branches

1-2 km

⭐⭐⭐⭐

Recreation

Sukhna Lake

12 km

⭐⭐⭐⭐⭐

Transportation

Bus Stand & Local Transport

3 km

⭐⭐⭐⭐

Investment Potential

Comparison with Other Housing Options

CHB vs Private Developers Comparison

Parameter

CHB Sector 53

Private Developers

Winner

Price (3BHK)

₹2.30 Cr

₹2.5-3.0 Cr

CHB

Land Ownership

Freehold

Freehold/Leasehold

CHB

Construction Quality

Government Standard

Variable

CHB

Delivery Timeline

36 months

24-36 months

Tie

Selection Process

Draw System

First Come First Serve

Private

Transparency

High

Variable

CHB

Legal Issues

Minimal Risk

Higher Risk

CHB

Amenities

Basic to Good

Premium

Private

Price Comparison with Similar Projects

Location Comparison Matrix

Location

Connectivity

Infrastructure

Future Growth

Overall Rating

CHB Sector 53

⭐⭐⭐⭐

⭐⭐⭐⭐

⭐⭐⭐⭐

4/5

Mohali IT City

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐

5/5

Panchkula Sectors

⭐⭐⭐

⭐⭐⭐

⭐⭐⭐

3/5

Zirakpur

⭐⭐⭐

⭐⭐⭐

⭐⭐⭐⭐

3.5/5

Financing Comparison

Latest Updates & Timeline

Current Status & Challenges

Aspect

Current Status

Issue/Challenge

EWS Policy

⚠️ Pending

15% EWS reservation mandated but no allocation policy exists

Launch Timeline

Delayed

Expected delay of 7-8 months from original September 2025 plan

RERA Registration

⏳ On Hold

Cannot proceed without EWS policy clarity

Layout Plan

Under Review

May need revision based on EWS policy requirements

Price Structure

✅ Finalized

Revised prices approved as per new collector rates

Detailed Timeline Analysis

What Applicants Should Do Now

1. Financial Preparation

2. Stay Updated

3. Alternative Options

Expected Revised Timeline

Milestone

Original Target

Revised Timeline

Status

EWS Policy Finalization

August 2025

December 2025

Under Review

Scheme Launch

September 2025

March 2026

Delayed

Application Period

October 2025

April 2026

Pending

Draw Process

November 2025

May 2026

Pending

Construction Start

January 2026

August 2026

Delayed

Expected Possession

January 2029

August 2029

Projected

Investment Analysis: Pros & Cons

Advantages of Investing in CHB Sector 53

? Financial Benefits

?️ Quality & Construction

? Location Advantages

Disadvantages & Challenges

⚠️ Process-Related Issues

? Financial Considerations

? Amenities & Features

Investment Score Card

Investment Parameter

CHB Sector 53 Score

Market Average

Rating

Price Competitiveness

8.5/10

6/10

Excellent

Location Value

7.5/10

7/10

Good

Quality Assurance

8/10

6.5/10

Very Good

Liquidity

7/10

6/10

Good

Rental Yield

6.5/10

6/10

Average

Capital Appreciation

7.5/10

7/10

Good

Risk Factor

8.5/10

5/10

Low Risk

Overall Investment Score

7.6/10

6.2/10

Very Good

Who Should Invest?

✅ Ideal Candidates

❌ May Not Be Suitable For

Investment Recommendation

Frequently Asked Questions

General Questions

Q1: What is the current status of CHB Sector 53 scheme launch?

Q2: How many flats are available under this scheme?

Q3: What are the current prices after revision?

Eligibility & Application

Q4: Who is eligible to apply for CHB Sector 53 flats?

Q5: Can I apply for multiple categories?

Q6: Do I need to reapply if I participated in the previous demand survey?

Financial & Payment

Q7: What is the EMD (Earnest Money Deposit) required?

Q8: Can I get a home loan for CHB flats?

Q9: What are the payment options available?

Process & Timeline

Q10: How does the allotment process work?

Q11: How long will construction take?

Q12: What happens if I'm not selected in the draw?

Investment & Legal

Q13: Is this a good investment option?

Q14: What are the additional costs involved?

Q15: Can I sell my CHB flat later?

Technical & Specifications

Q16: What amenities are included in the project?

Q17: What is the quality of construction?

Q18: Is parking guaranteed for all flats?

Official Contacts & Support

Chandigarh Housing Board Contact Details

Contact Type

Details

Purpose

Office Address

Chandigarh Housing Board

Sector 9-D, Chandigarh - 160009Physical visits, document submission

Phone Numbers

0172-4601827

0172-2511131-39General inquiries, scheme information

Email

chbchd@gmail.com

Written queries, document submission

Website

chbonline.in

Online applications, updates, downloads

Office Hours

Mon-Fri: 9:00 AM - 5:00 PM

Saturday: 9:00 AM - 1:00 PMPublic dealing hours

Important Official Links

Department-wise Contact Information

Department

Contact Person/Designation

Contact Details

Chief Executive Officer

CEO, CHB

0172-2511131

Housing Schemes

Assistant Engineer (Housing)

0172-4601827

Accounts & Finance

Accounts Officer

0172-2511133

Technical Queries

Executive Engineer

0172-2511135

Alternative Information Sources

Government Portals

Financial Support

Tips for Contacting CHB

Best Practices

What to Avoid