RBI Repo Rate Cut to 5.25%: Home Loan EMIs to Drop Sharply – Full Impact Explained

The RBI has cut the repo rate by 25 bps to 5.25% in December 2025 — the fourth cut this year totalling 125 bps — pushing home loan rates to 7.10–7.35%.

In its final bi-monthly policy of 2025, the Reserve Bank of India (RBI) on Thursday slashed the repo rate by 25 basis points to 5.25%. This is the fourth cut this calendar year – February (-25 bps), April (-25 bps), June (-50 bps), and now December (-25 bps) – taking the total reduction to 125 basis points in just 11 months. The sharpest easing cycle since the Covid year of 2020 has brought the repo rate to its lowest level since April 2020. For the 15 crore Indians paying home loans, this is major relief. Banks have already started cutting lending rates. Public sector giants like State Bank of India, Union Bank of India and Bank of Baroda are offering home loans starting at 7.10–7.35%, down from 8.50–9.00% at the beginning of 2025. Private lenders HDFC Bank, ICICI Bank and Axis Bank are expected to follow within days. For personalized home loan comparisons and applications, visit Ambak.com, which offers zero-commission services and rates starting at 7.35%. This article explains everything you wanted to know: how the repo rate works, how much your EMI will fall, exact savings on popular loan sizes, history of rate cuts, rules of safe borrowing, and practical steps to grab the maximum benefit.

What Exactly is the Repo Rate?

The repo rate is the interest rate at which the RBI lends money to commercial banks for one day to one year. When banks borrow cheaper, they pass on the benefit to customers by reducing loan rates. When RBI raises the repo rate, borrowing becomes costly.

Since October 2019, RBI has made it compulsory for banks to link all new floating-rate home loans to an external benchmark – mostly the repo rate itself. These are called Repo-Linked Lending Rate (RLLR) or External Benchmark Linked Lending Rate (EBLR) loans. The formula is simple:

Home loan interest rate = Repo rate + Bank’s fixed spread (usually 2.25% to 3.50%)

Example (SBI current offer): Repo rate 5.25% + Spread 1.85% = Final rate to customer 7.10%

Because the spread is fixed, every 25 bps cut in repo directly reduces your home loan rate by exactly 25 bps – no excuses. To calculate your potential EMI savings, use the EMI calculator on Ambak.com.

Full History of RBI Repo Rate Changes (2020–2025)

| Period | Repo Rate | Change (bps) | Reason / Event |

|---|---|---|---|

| Mar 2020 | 4.40% | -75 | Covid lockdown – emergency stimulus |

| May 2020 | 4.00% | -40 | Deepest cut ever to save economy |

| May 2022 | 4.40% | +40 | Start of global inflation fight |

| Jun–Aug 2022 | 4.90–5.40% | +90 | Russia-Ukraine war, oil shock |

| Dec 2022 | 6.25% | +35 | Inflation still high |

| Feb 2023 | 6.50% | +25 | Peak rate – held for 20 months |

| Feb 2025 | 6.25% | -25 | Inflation collapses to 0.25% in Oct 2025 |

| Apr 2025 | 6.00% | -25 | Growth slowdown fears |

| Jun 2025 | 5.50% | -50 | Aggressive 50 bps cut to boost festive demand |

| Dec 2025 | 5.25% | -25 | Fourth cut – lowest since April 2020 |

Total cut in 2025: 125 basis points Current repo rate: 5.25% (lowest in 5½ years)

Exact EMI Reduction After Every Cut in 2025

Take a ₹50 lakh home loan for 20 years (240 months). Here is how your EMI has come down step by step this year:

| Date | Repo Rate | Typical Home Loan Rate | Monthly EMI (₹) | Monthly Saving vs Jan 2025 | Cumulative Saving (20 yrs) |

|---|---|---|---|---|---|

| Jan 2025 | 6.50% | 8.75% | 44,165 | – | – |

| Mar 2025 | 6.25% | 8.50% | 43,391 | 774 | 1.86 lakh |

| May 2025 | 6.00% | 8.25% | 42,623 | 1,542 | 3.70 lakh |

| Jul 2025 | 5.50% | 7.75% | 41,301 | 2,864 | 6.87 lakh |

| Dec 2025 | 5.25% | 7.50% | 40,550 | 3,615 | 8.68 lakh |

On a ₹50 lakh loan, your EMI has fallen by ₹3,615 per month compared to January 2025. Over the remaining tenure, total interest saving is nearly ₹9 lakh.

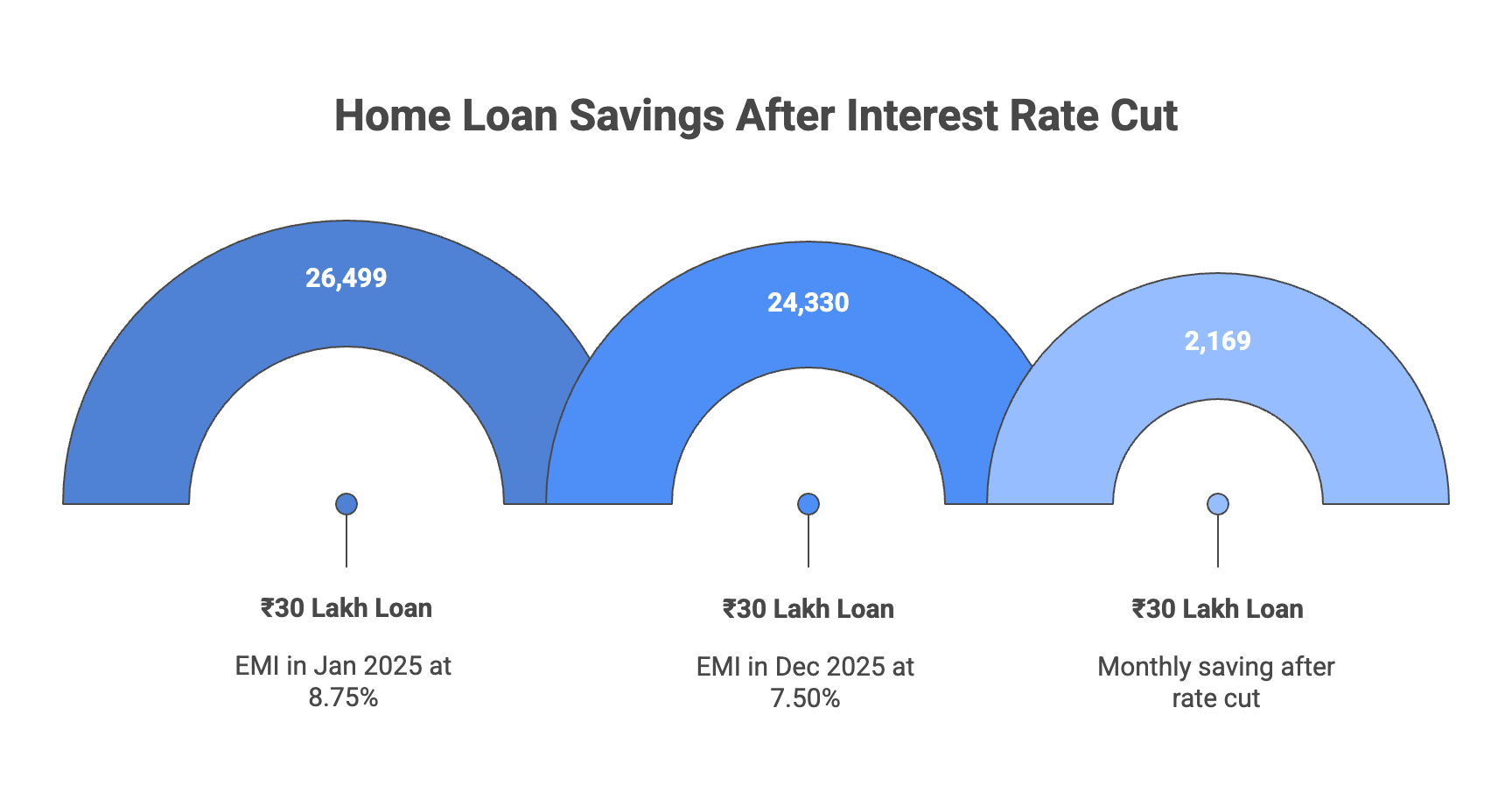

Savings Table for Popular Loan Amounts (20-year tenure)

| Loan Amount | Rate Jan 2025 (8.75%) | EMI Jan 2025 | Rate Dec 2025 (7.50%) | EMI Dec 2025 | Monthly Saving | Total Interest Saved |

|---|---|---|---|---|---|---|

| ₹30 lakh | 8.75% | 26,499 | 7.50% | 24,330 | 2,169 | ₹5.21 lakh |

| ₹40 lakh | 8.75% | 35,332 | 7.50% | 32,440 | 2,892 | ₹6.94 lakh |

| ₹50 lakh | 8.75% | 44,165 | 7.50% | 40,550 | 3,615 | ₹8.68 lakh |

| ₹75 lakh | 8.75% | 66,247 | 7.50% | 60,825 | 5,422 | ₹13.01 lakh |

| ₹1 crore | 8.75% | 88,330 | 7.50% | 81,100 | 7,230 | ₹17.35 lakh |

Even a 1% drop (from 8.5% to 7.5%) saves ₹5–17 lakh depending on loan size. The 1.25% drop in 2025 is therefore a windfall.

Does a 1% Interest Rate Really Make a Big Difference?

Yes. Example on ₹60 lakh loan for 20 years:

- At 8.50%: EMI = ₹52,070; Total interest paid = ₹65.0 lakh

- At 7.50%: EMI = ₹48,330; Total interest paid = ₹56.0 lakh

- Monthly saving = ₹3,740

- Total interest saved = ₹9.0 lakh (14% less interest)

The longer the tenure, the bigger the saving. On a 30-year ₹60 lakh loan, the same 1% drop saves almost ₹15 lakh in interest.

What is the 20-30-40 Rule for Home Loans?

This is the golden rule followed by smart borrowers and most financial planners:

- 20% Down Payment Never borrow more than 80% of property value. Example: ₹80 lakh flat → Minimum ₹16 lakh own money → Loan only ₹64 lakh.

- 30% EMI-to-Income Rule Your home loan EMI should never cross 30% of your take-home salary. Monthly salary ₹1.2 lakh → Max EMI ₹36,000 → Max loan at 7.5% ≈ ₹45 lakh (20 years).

- 40% Savings & Lifestyle Buffer After EMI and essentials, at least 40% of income should be left for investments, emergencies, vacations and children’s education.

If you break any one of these, you risk financial stress. Banks themselves reject applications if EMI crosses 35–40% of income. For more guides on home loan eligibility, check Ambak's blog.

What is the 40% Total EMI Rule Used by Banks?

While the 20-30-40 rule is advice, banks strictly follow the 40% Debt Burden Rule (also called FOIR – Fixed Obligations to Income Ratio). Total EMIs of ALL loans (home + car + personal + credit card) ≤ 40% of gross monthly income. Example: Gross salary ₹1.5 lakh Car loan EMI ₹15,000 Credit card minimum ₹3,000 Maximum home loan EMI allowed = ₹42,000 (40% of ₹1.5 lakh minus ₹18,000) If you already have heavy commitments, even a low interest rate won’t help you get a big home loan.

How to Force Your Bank to Reduce Interest Rate Immediately

Old MCLR loans (pre-Oct 2019) do not drop automatically. Repo-linked loans reset every 3 months, but you can still speed things up.

- Switch from MCLR to Repo-linked (conversion fee ₹5,000–15,000 + GST, worth it).

- Balance Transfer to another bank offering 7.10–7.25%. Processing fee 0.5–1% of outstanding loan, usually recovered in 10–14 months through lower EMI. Explore Ambak's balance transfer options for seamless switches.

- Prepay 5–10% every year (most banks allow free prepayment up to 20–25% per year on floating loans).

- Increase EMI instead of reducing it – finish loan 4–6 years early.

Real example: A borrower with ₹68 lakh outstanding at 8.40% transferred to SBI at 7.10% in November 2025. Monthly saving ₹9,800; total interest saved ₹22 lakh.

Latest Home Loan Interest Rates (6 Dec 2025)

| Bank | Starting Rate | Processing Fee | Special Offers |

|---|---|---|---|

| State Bank of India | 7.10% | 0.35% | Women co-borrower 7.05% |

| Union Bank of India | 7.15% | Nil till Dec 31 | Nil processing for loans >₹50L |

| Bank of Baroda | 7.20% | 0.25% | 7.10% for 700+ CIBIL |

| HDFC Bank | 7.30% | 0.50% | Balance transfer 7.25% |

| ICICI Bank | 7.35% | 0.50% | 7.20% for salaries >₹1 lakh |

| Axis Bank | 7.40% | 0.50% | Top-up at same rate |

Rates valid till 31 December 2025 or till next policy. Compare more rates at Ambak.com.

Frequently Asked Questions (FAQs)

Q. How much EMI will reduce after the latest 25 bps repo cut?A. Roughly ₹190–230 per month for every ₹10 lakh outstanding (20-year original tenure). Q. When will my bank reduce the rate? A. Repo-linked loans reset within 30–90 days. Some banks like SBI do it from the very next month. Q. I have an old 2018 loan at 8.65%. What should I do? A. Convert to repo-linked (small fee) or transfer balance to a bank offering 7.10–7.25%. Q. Will home loan rates fall further in 2026? A. If inflation stays below 4% and US Fed also cuts, another 50–75 bps repo cut is possible by mid-2026. Q. Is it a good time to buy a house? A. Yes. Property prices rose only 6–8% in 2025 while loan rates fell 125 bps – effective affordability is at a 15-year high. Q. My bank says “spread is fixed, rate will come down automatically”. Is it true? A. 100% true for all loans taken after October 2019. For more FAQs and guides on home loans, visit Ambak's blog, including posts like Home Loan for Expats in India 2025 or Joint Home Loan with Wife. The RBI’s aggressive 125 bps cut in 2025 has handed home loan borrowers savings running into lakhs of rupees. Whether you are paying an existing loan or planning to buy your first home, act fast – check your rate, switch if needed, and lock in the lowest rates in half a decade.